New rating valuations for Buller District Council

Property owners in Buller District soon receive a Notice of Rating Valuation in the post with an updated rating value for their property.

The new rating valuations have been prepared for 7,933 properties on behalf of the Buller District Council by independent valuers Quotable Value (QV). Their careful analysis shows the total rateable value for the district is now $3.7 billion, with the land value of those properties now valued at $2 billion.

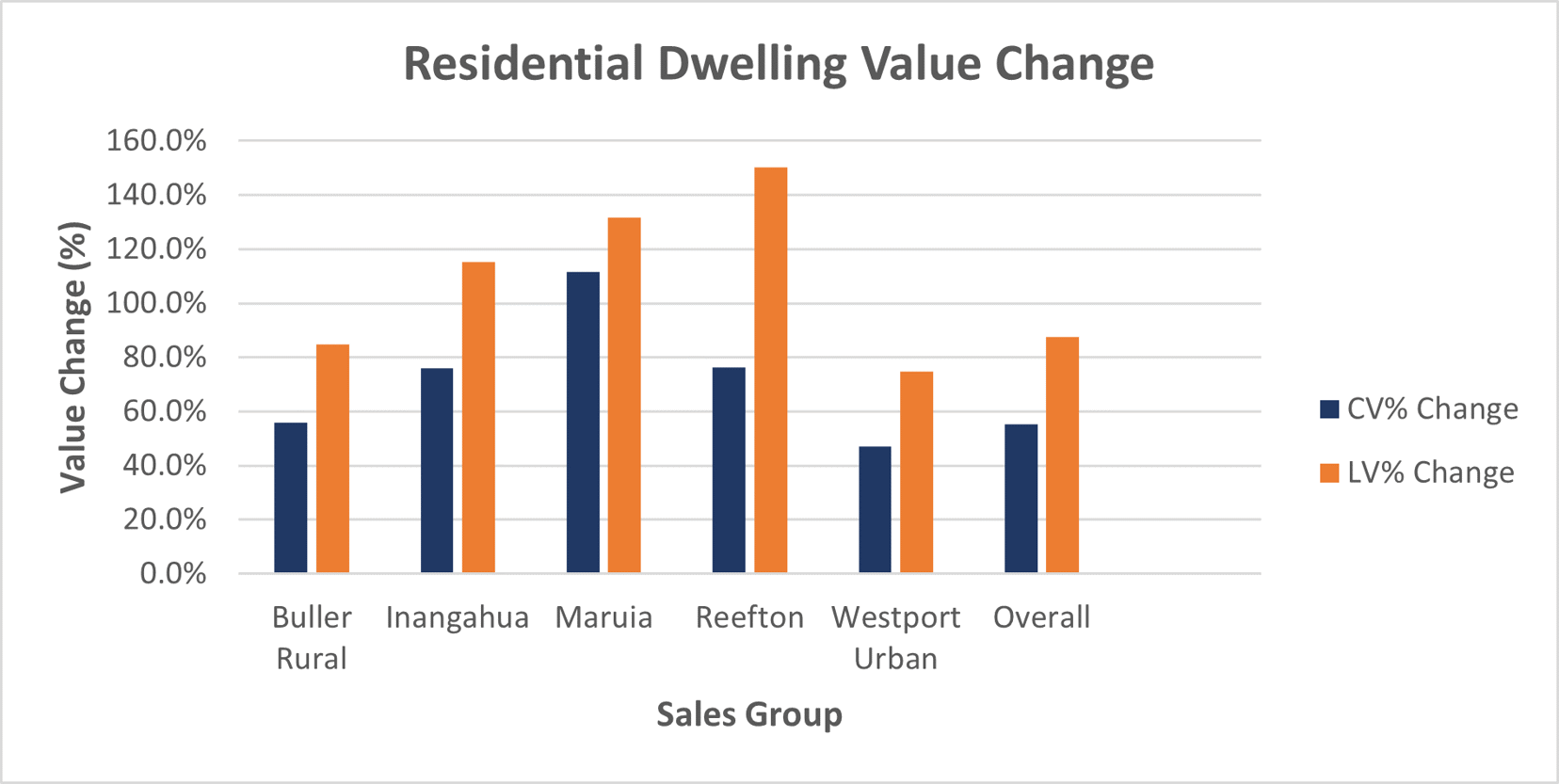

On average, the value of residential housing has increased by 55% since the district’s last rating valuation in 2019, with the average house value now sitting at $341,000. The corresponding average land value has also increased by 88% to reach a new average of $119,000.

Senior Consultant and lead valuer Clementine Rankin commented: “Buller’s average house price is still amongst the lowest in New Zealand, so affordability has obviously been a major selling feature. Although the district has experienced flooding in mid-2021 and early 2022, residential properties are still generally selling well above their 2019 market level.”

Meanwhile, she said the local commercial and industrial sectors have had comparatively moderate increases across the district. Commercial property values increased by 27% on average, and property values in the industrial sector have increased by 29% since the district’s last rating valuation. Commercial and industrial land values have also increased by 72% and 64% respectively.

“Interest rates have been low, with some investors opting for business property investments to obtain better investment returns. Lower international tourist numbers over the last three years continue to impact the commercial accommodation sector, but re-opening the border and lowering national restrictions has increased tourism in the district. Other sectors, such as supermarkets, have flourished over the same time period.”

Since 2019, the average capital value of an improved lifestyle property has increased by 58% to $420,000, while the corresponding land value for a lifestyle property increased by 70% to $239,000.

“The lifestyle market has seen strong growth since 2019, with a lower price point than other areas appealing to those wishing to begin lifestyle living or looking to retire in the area. Since recent flooding events, the market has been stronger in areas that are less prone to flooding,” Miss Rankin added.

Rural sales numbers fell in the district from 16 in 2021 to nine in 2022, which Miss Rankin said reflected a “varied market” where small dairy and pastoral blocks sold strongly over the three years to 2022, but full scale dairy units were stagnant to decreasing in value.

“This is related to increased costs, compliance, and availability of lending. Unlike other parts of the country, commercial forestry is not a central player in the Buller market, with traditional dairy being the predominant sector. Mining has also been dynamic, with both the closure of the Heaphy coal mine and the resource consent approval for the Mineral Sands mining operation near Cape Foulwind.”

“We have also seen a number of benchmark sales in the dairy and pastoral sector over the last three years, with sales occurring into the $6 million figures. These sales reflect the quality of land in the district and underpin that high value purchasers continue to exist in the local market,” Miss Rankin added.

Background

Rating valuations are usually carried out on all New Zealand properties every three years to help local councils set rates for the following three-year period. They reflect the likely selling price of a property at the effective revaluation date, which was 1 October 2022, and do not include chattels.

It is helpful to remember that any changes in the market since that time will not be included in the new rating valuations. Often this means that a sale price achieved in the market today will be different to the new rating valuation set at 1 October 2022.

The updated rating valuations are independently audited by the Office of the Valuer General and need to meet rigorous quality standards before the new rating valuations are certified. They are not intended to be used as market valuations for raising finance with banks or as insurance valuations.

New rating values will soon be posted to property owners. If owners do not agree with their rating valuation, they have a right to object through the objection process before 8 June 2023.

-ENDS-

further information please contact:

Simon Petersen

QV Communications Manager

Simon.Petersen@qv.co.nz

(09) 361 7216